See what your cards are really worth and get AI-driven strategies to get the most from your cards.

See annual fees, benefits, and net value at a glance. Know exactly what each card costs and delivers.

"Which card should I use?" "Plan my vacation." "Optimize big purchases." Tools that answer your real questions.

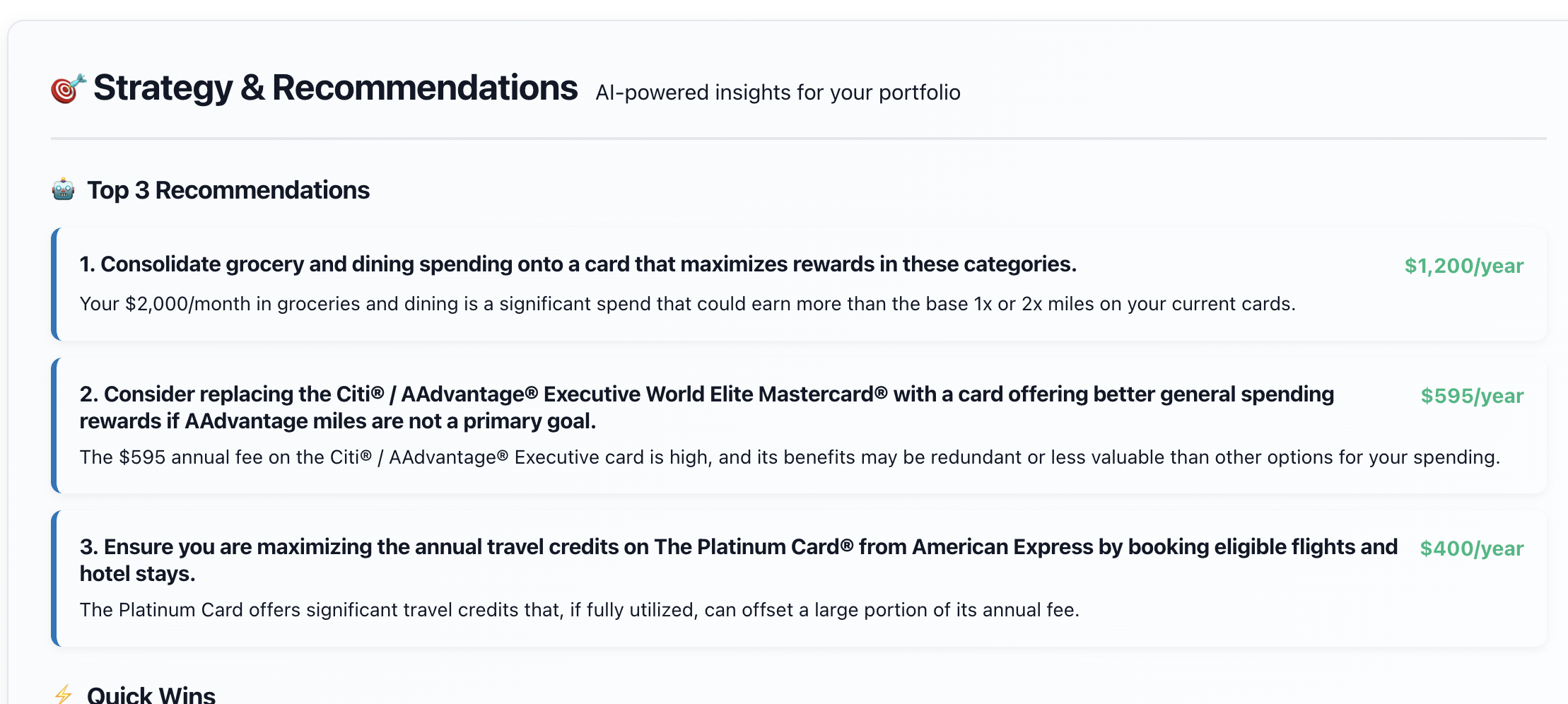

Get personalized advice on maximizing your card rewards based on your actual spending patterns.

Select a spending category and instantly see which of your cards earns the most rewards.

Try It →Planning a trip? Optimize your card usage for flights, hotels, dining abroad, and more.

Try It →Big purchase coming up? Find the best card for electronics, appliances, and major buys.

Try It →Search and add your credit cards in seconds. We support 100+ cards from all major issuers.

View annual fees, benefits, and break-even analysis. Understand what you're actually getting.

Use calculators to maximize every purchase. Get the most from your existing cards.

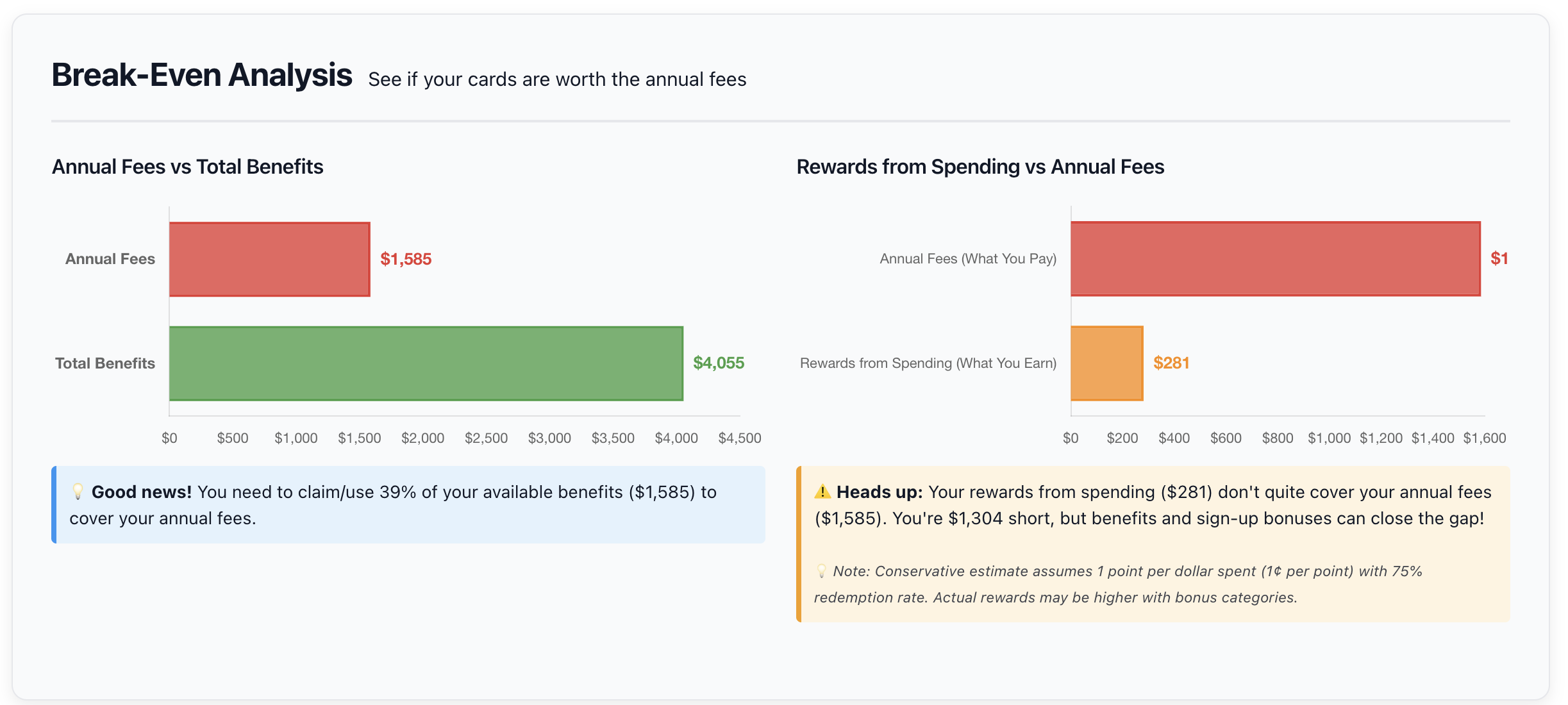

See if your cards are worth the annual fees

Get AI-powered recommendations to maximize value

Join cardholders who receive:

Add your card to KoKo and we'll calculate your break-even point. We factor in annual credits, benefits value, and rewards rates to show exactly how much you need to spend to make the fee worthwhile.

It depends on your cards! Use our "Which Card to Use" calculator to compare your cards' rewards rates for groceries. Cards like Amex Blue Cash Preferred offer 6% back, while others may offer 2-3x points.

Add your cards to KoKo's My Cards feature and we'll show you a side-by-side comparison of rewards rates, benefits, and annual fees. You can also use our Discovery page to compare any cards in our 100+ card database.

Yes, KoKo is completely free. We help you analyze and compare credit cards with no hidden fees, no costs, and no subscription required.

No. KoKo works without any bank connections. You can get valuable insights just by adding your card names.

Break-even analysis calculates how much you need to spend on a card to offset its annual fee. We factor in statement credits, benefit values, base rewards rate, and point valuations to give you a clear spending target.